Average annual physician salaries are well reported and easily available online. But estimating a doctor’s career earnings can be difficult. How much would the average doctor make throughout their entire career?

In general, a primary care physician will make $8,505,000 before tax while a specialist physician will make $12,110,000. These numbers assume a 35 year career after residency. Current annual average salaries for physicians are $243,000 for primary care physicians and $346,000 for specialists.

Over the course of their careers, physicians will make a lot of money! But those high numbers don’t tell the whole story. To calculate the real earnings of a doctor after taxes and other considerations, you have to go through a few more steps. There are a number of ways how physicians make significantly less than their pre-tax earnings, but also ways for them to make even more.

Let me show you

Calculating Lifetime Physician Earnings

Every year, Medscape conducts their annual physician compensation report which is by far the best available source for physician salaries. In 2020, the most recent report as of this blog post, the current average salaries for physicians are $243,000 and $346,000 for primary care physicians and specialist physicians, respectively.

To calculate lifetime earnings, we need to know both how much a physician makes in addition to how many years they work. If we assume an average retirement age of 65 and residency graduation at age 30, that gives 35 years of income generation. Multiply years worked by annual income, and we can get the average total career earnings for a physician:

$8,505,000 lifetime earnings for a primary care physician.

and

$12,110,000 lifetime earnings for a specialist.

Looking at those numbers, it doesn’t seem so bad for doctors, right? And if all you want to know is pre-tax earnings you can stop right there. But if you want to dig a bit deeper and know a doctor’s real, actual earnings you’ll need to understand a few more things. There are a number of ways doctors end up with much less money than you think, and a few ways they can actually make more.

The 6 Ways Physicians Make Less Money

1: Doctors pay a LOT in taxes.

Salary data that you see online like the Medscape survey usually only represent pre-tax data. That’s because accounting for taxes can be very difficult to generalize for everyone. Everyone pays taxes, but not everyone pays the same rate.

When we talk about taxes on physician’s earnings, we’re talking about income taxes. And there are a few different types of income taxes.

You’re probably familiar with the federal income tax, but you may not be as familiar with FICA taxes or state taxes. I’d like to explain the difference by looking at a couple of realistic scenarios.

Let’s take another look at both of the doctors I mentioned previously. Our primary care physician makes $243k on average while our specialist makes $346k. We know now that these amounts are not what our doctors take home. First, let’s take a look at their federal taxes.

How much do they pay? If you’re familiar with federal income taxes, you’ve probably heard of tax brackets. And you may know that doctors typically find themselves in the highest tax bracket.

Interestingly, both the PCP and specialist find themselves in the same 35% federal tax bracket despite their different salaries. More interesting is that neither actually pays 35% of their income in federal taxes! That’s because the income tax bracekts in the United States are progressive. That means only the amount in each bracket is taxed at that level, while any income above that amount is taxed the next highest level, and so on.

Let me show you how that works with the following chart. On the left you’ll see the rate for each bracket, then what range of income is taxed at that rate. Then, you’ll see the amount each of our doctors pays into the brackets with their final federal tax rate and take home pay after federal tax at the bottom.

| Tax Rate | Taxable Income Bracket | PCP Taxes Owed by bracket | Specialist Taxes Owed by bracket |

| 10% | $0 to $9,875 | $987.50 | $987.50 |

| 12% | $9,876 to $40,125 | $3,629.88 | $3,629.88 |

| 22% | $40,126 to $85,525 | $9,987.78 | $9,987.78 |

| 24% | $85,526 to $163,300 | $18,665.76 | $18,665.76 |

| 32% | $163,301 to $207,350 | $14,095.68 | $14,095.68 |

| 35% | $207,351 to $518,400 | $12,477.15 | $48,527.15 |

| 57% | $518,401 or more | $0 | $0 |

| Total Paid | $59,843.75 | $95,893.75 | |

| Federal Tax Rate | 24.62% | 27.71% | |

| Take Home Pay After Federal Tax | $183,156.25 | $250,106.25 |

You may have noticed that even though both doctors pay 35% taxes on some of their income, that only applies to the highest bracket rather than all of their income. Because lower amount are taxed at lower levels, neither physician owes more than 28% of their income in federal taxes.

However, income taxes don’t stop there.

Next, you need to account for FICA taxes, which are taxes on social security and medicare. You may have also heard of these as payroll taxes. These taxes are actually split between the employer and the employee, but they can add up to another 6.2% on income up to $142,800 on social security, plus 1.45% for medicare for doctors. It looks something like this.

| Employee | Employer | |

| Social Security Tax (only on the first $142,800 in 2021) | 6.2% | 6.2% |

| Medicare Tax | 1.45% | 1.45% |

| Additional Medicare Tax (on earnings over $200,000 for single filers) | 0.9% | |

| Total | 7.45-8.55% | 7.65% |

Because there’s a cap on social security tax ($142,800 in 2021), every dollar above that amount doesn’t pay 6.2% tax. That means anyone making over that amount will actually pay a lower percent in FICA taxes, including doctors. So doctors will usually pay between 4-7% in FICA taxes.

And lastly, to calculate a doctor’s income taxes, you need to account for state taxes. State taxes are highly variable and range anywhere from 0% in states like Texas and Florida to 13.3% in California. I recommend taking a look at the income taxes for your state to better understand your own situation.

Now that we know the three types of income taxes, let’s check back in with our two doctors. After we account for federal, payroll, and state income taxes (let’s assume they live in Virginia for this example), we can see their true after tax income.

| PCP | Specialist | |

| Pre-tax Income | $243,000 | $346,000 |

| Federal Tax | $59,843 | $95,893 |

| FICA Tax | $12,448 | $14,868 |

| State Tax | $13,403 | $19,325 |

| Overall Tax Rate | 35% | 38% |

| Post Tax Income | $157,306 | $215,914 |

That shows our PCP pays $85,694 per year in income taxes and our specialist pays $130,086.

Now let’s take a look at how income taxes affect their career earnings. Here are the new numbers:

$5,505,710 after tax lifetime earnings for a primary care physician. ($2,999,290 less than pre-tax)

$7,556,990 after tax lifetime earnings for a specialist physician. ($4,553,010 less than pre-tax)

2: Doctors must pay off their student loans

The next major factor that limits a doctor’s lifetime earnings is student loans. Physicians may have anywhere from $0 in student loans to over $500,000 by the time they graduate residency and begin their careers. The average new attending will have approximately $240,000 in student loans to pay back.

There are many ways to go about tackling your student loans. Some doctors decide to pay them off as soon as possible, a strategy which is completely doable within 5 years of graduating residency. However, this will greatly cut into your early career earnings.

Another way to tackle your loans is through income-based repayment. If you utilize this strategy and meet the criteria, you might qualify for public service loan forgiveness after 10 years. Typically, this plan requires you to make monthly payments equal to 10% of your discretionary income.

What is discretionary income? Technically, it’s “the amount of money you have left after necessary expenses are paid”. No, you don’t get to decide the number and tell the government how much you spend on expenses. Instead, they use a formula to tell you what your discretionary income is. If you want to figure out how they do it, follow these steps:

- Find the federal poverty guideline for your location and family size.

- Multiply that number by 1.5.

- Subtract that number from your adjusted gross income.

- Then, multiply the result by 10% to get your income-based loan payment.

For our two doctors, our primary care physician’s 10% income based payment is $1,807/mo ($21,684/year), and for the specialist physician, $2,666/mo ($31,992/year)

Interestingly, if you map out those payments on a 240k loan, neither doctor will pay off their loans completely within 10 years, although the specialist will come close. Our primary care physician will have over $100,000 forgiven through public service loan forgiveness while the specialist will only have a few hundred dollars forgiven.

Due to the low amount of forgiveness, the specialist would probably be better off refinancing and paying them off sooner, but for the sake of calculating our lifetime earnings, let’s assume 10 years of income based loan repayment for both doctors.

Now our new equation for lifetime earnings is:

(after tax salary – [income based payment]) * 10 + (after tax salary *25)

After accounting for loans, these are our new numbers.

$5,288,870 after tax lifetime earnings for a primary care physician with 240k in student loans.

$7,237,070 after tax lifetime earnings for a specialist physician with 240k in student loans.

The next few ways that doctors earn less are much more difficult to calculate exact numbers for, but nevertheless they are important and apply to nearly all physicians.

3: Simply being a doctor costs money every year.

Even after paying hundreds of thousands to go to med school and taking a lower salary in residency, there are still ongoing costs doctors have to pay throughout their careers. If you’re in medicine, you might already be familiar with some of these:

- Maintenance of certification

- Medical License Fees

- Continuing Medical Education

- DEA Licenses

- Membership Fees

- Malpractice Insurance

- And more….

The exact amount a doctor will pay for these costs varies by location and specialty. But they can typically add up to anywhere from $2,000 to $10,000 every year. That’s another $70,000 to $350,000 decrease in career earnings.

If you’re lucky, your employer might cover some of these costs for you. But if they don’t, or if you’re self employed or run your own business, you’ll still have to pay.

4: Doctor’s actual collections change every year

At least in the USA, the vast majority of patients seen by doctors are either uninsured or on Medicare. If they’re not, their insurance probably reimburses physicians based on the medicare rate. But how does medicare determine their rate?

Medicare is a government sponsored program that insures people aged 65 and older and younger people with disabilities. It’s essentially a gigantic insurance provider for one of the largest population groups in the country. As a result of its massive scale, it has a lot of negotiating power. That means it can set rates, and it does so with something known as Relative Value Units, or RVUs.

This is how it works. As a doctor, you’ll see a patient and write a note the explains what you did. Depending on both what you did and what you wrote about what you did, you can bill for a specific code. Level 3 patient visit, Level 4 patient visit, etc. Each code correlates to its own amount of RVUs. These billing codes are then sent to a billing department who charges the patient’s insurance for that service. Once approved, the insurance company pays $X for each correctly billed RVU.

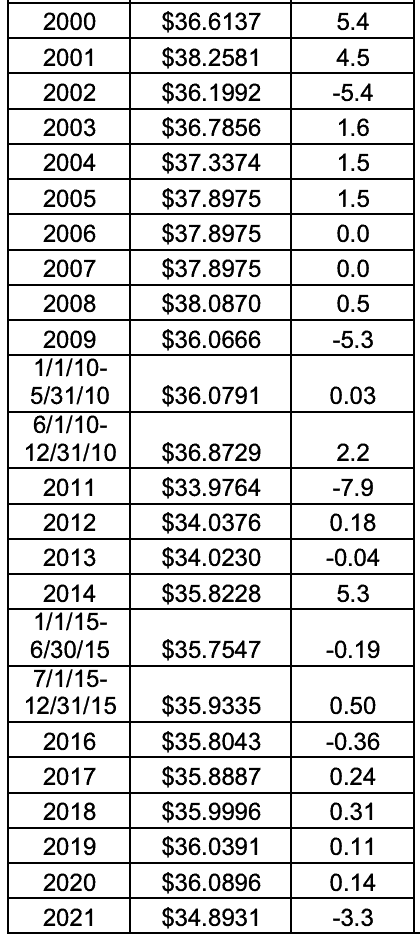

What is X? It’s determined by medicare, and it’s always changing. Thankfully the data is public and you can see the changes for yourself. Here’s the dollar amount and % change per year since 2000.

As you can see, in any given year a doctor might may more or might make less money. In fact, in 2021, doctors actually make less per RVU than in 2000 after medicare decided to pay 3.3% less per RVU from 2020 to 2021. That’s a 3.3% decrease in physician salaries.

What this also shows is that you, a doctor, may do the same exact thing every year providing medical care to your patients, but you’ll make a different amount of money each year doing it.

5: Doctors make less money over time

In most businesses, employees typically make more money over time. Just look at a software engineer’s career earnings, for example. Whether through raises, new jobs, or new titles, the general salary trend over the course of a career is up. However, this is not the case with doctors. At least for doctors who work as employees.

As employees, doctors are undoubtedly paid well. But what most people don’t realize is that physician wages don’t grow over time. For example, when Mrs. Average Doctor and I started our first jobs, we were making the same salary as our peers who had been working for 10+ years. There’s simply no higher salaries for employed docs with more experience at our jobs. No mechanism for increasing wages over time.

It’s a bit of a double edged sword. Would you prefer to make your max salary on your first day of work instead of your last? Absolutely. But if you keep making that same salary, you actually end up making less real money year over year over the course of your career. That’s because inflation, the devaluing of money over time, means that the same $1 you make in 30 years is worth less than the $1 you made today.

Now, it is possible to change jobs or obtain a higher level of training through fellowship and make a higher salary. Or maybe you work with an employer who does include a mechanism for raises in your contract. But for most physicians, outside of running their own medical businesses and growing them over time, or medicare adjusting their conversion factor rates for RVUs, doctors actually tend to make less money as they advance in their careers.

6: Doctors do not have as much job security as you think

When I was first looking into going to medical school, I heard the same thing from everyone, “Go to medical school, be a doctor, and you’ll always have a job!”. Now that I’m actually working as an attending, I see more and more how that’s not the case. Doctor’s don’t have perfect job security.

I believe this is a new trend. In the past, it was much more common for physicians to own their own practices. Your local doctor would run his own office. Surgeons would maintain their own patient panels. And even emergency physicians would be part owners of a small emergency medicine group. It was pretty common then to work a 30+ year career.

Now, more and more, doctors are less likely to become practice owners, and more likely to work as employees. I can’t say for sure whether this is overall a good thing or a bad thing, but I can say that it does have a major impact on job security.

I mean, imagine if you were a business owner. Would you be more likely to fire yourself or fire one of your employees? Would that change if your employee was a doctor?

But doctors are doctors. They shouldn’t be getting fired unless they did something really terrible, right? Well, you’d be surprised. Plenty of doctors have gotten fired for reasons that don’t include something terrible. Reasons like spending too much time with patients, low (flawed) patient satisfaction metrics, because a large private equity corporation bought out their group and just didn’t want them, and because those same groups replaced them with non-physician medical providers because they cost less to employ.

None of this is to say that medicine is all doom and gloom, but when a 35 year career isn’t guaranteed, it’s a lot harder to calculate a physician’s career earnings ahead of time.

Ways Doctors Can Earn More Money

Along with all of the ways that doctors end up making less money over their careers than you think, there are also a number of ways for them to make even more.

To combat higher taxes, they can invest in tax-protected investment accounts like 401ks and 457s. They can also acquire assets to increase their amount of “non-earned” income compared to their “earned” income (income from investments like stocks and real estate are taxed at a much lower level, and in some cases even not at all).

They can find ways to graduate medical school with less or even zero debt.

Or simply learn how to save more money and avoid lifestyle inflation.

Through these and many other strategies that we’ll discuss in this blog, doctors can negate the negatives, generate more revenue, and potentially even achieve financial independence.

Conclusion

In this post, I wanted to show you that figuring out a doctor’s career earnings isn’t as simple as multiplying a number you found online by the years in a career. Doing that does give you an impressive number, but the truth is a lot more complicated.

Yes, doctors are well paid, and we’re among the highest earners in the country making millions after tax over the course of our careers. But doctors might not make as much as you think. There’s a lot that determines how much money they and up with. And making millions doesn’t always make you a millionaire.