It’s well known that doctors graduate medical school with a lot of student loan debt. We know the average debt is somewhere around $200,000, with some owing as much as $500,000. But how long do doctors carry that debt once they’re done with training?

Average medical school loans can be paid off in under 5 years. However, physicians have a number of alternatives for loan repayment. A majority of physicians are pursuing public service loan forgiveness, which takes 10 years but may cost less overall. Other options that doctors consider include refinancing, military service, and employer student loan bonuses.

How Long Actual Doctors Take To Repay Their Student Loans

Exactly how long it takes to pay off your loans after medical school can vary widely by individual. Physicians have a number of options for paying off their loans. Some may “live like a resident” and get rid of their debt as soon as possible. Others are pursuing loan forgiveness through PSLF, or public service loan forgiveness. And some even choose to make the minimum payments over the duration of their loan.

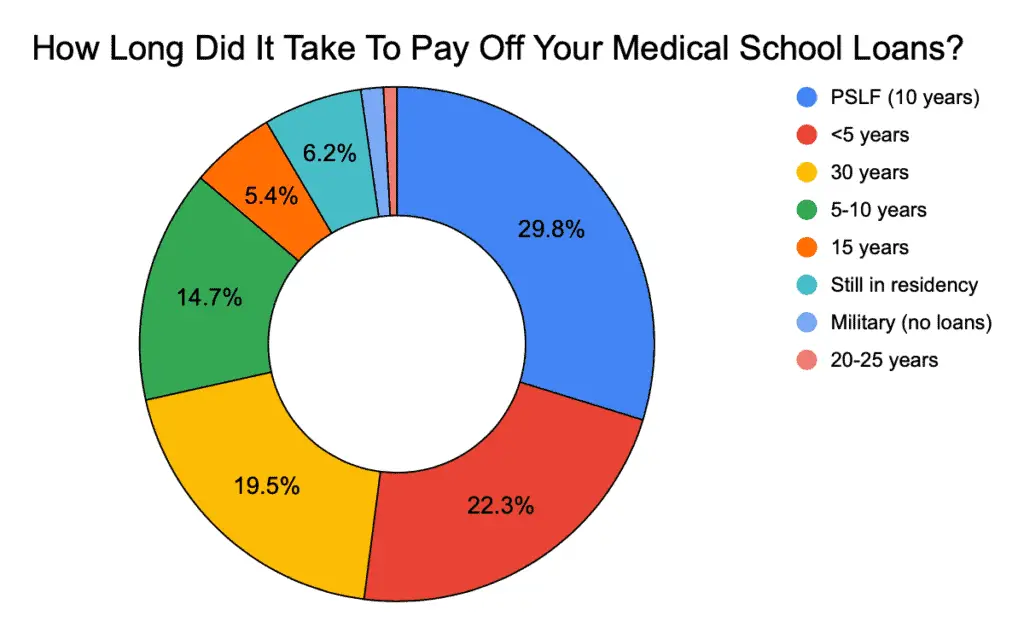

I know how Mrs. Average Doctor and I approached our student loans. But I wanted to know what strategies other doctors are using. So I asked members of a verified physician only facebook group and got over 700 responses. This is what they shared:

According to the chart, the vast majority of doctors choose either public service loan forgiveness, pay off their loans as soon in less than five years, or wait out the duration of their loan term. Let’s discuss why someone might choose each option.

Public Service Loan Forgiveness (PSLF)

PSLF is a federal government run program where the government will forgive all of your remaining direct federal loans in return for public service. The qualify for PSLF, according to the program, you must:

- Work full time for a US federal, state, local or tribal government or not-for-profit organization

- Have Direct Loans

- Repay your loans under an income driven repayment plan; and

- Make 120 qualifying payments

For doctors who meet these requirements and have either a large student loan debt burden or a lower than average salary this 10 year (120 payment) program can be incredible. That’s why this was by far the most popular loan repayment strategy in our survey, with 29.8% (211/709) saying they’re pursuing PSLF.

There are two additional bonuses to PSLF.

First, the program starts counting payments in residency, payments which are based on your much lower residency salary. So most attendings actually start their careers with 36 months (or three years) of qualifying payments already made.

Secondly, during the 2020 Covid-19 Pandemic, the federal government set federal student loan interest rates to 0% and suspended loan payments. On top of this, every month of suspended payments counted as a month of qualified payments toward PSLF.

However, PSLF isn’t the best option for everyone. Which leads us into the next repayment strategy.

Loan Repayment in Under 5 Years

If your loans amounts are too low or your salary is too high, you might not benefit at all from PSLF. Because the PSLF system is based on income-based payments, you might either see little benefit from PSLF or see no benefit if your income-based payments would completely pay off your loans in less than 120 payments (10 years).

For those doctors, refinancing makes more sense than PSLF.

While it doesn’t make sense to refinance your federal loans into private loans when the government sets federal student loan interest rates to 0%, outside of that very specific situation, it can be a great option. Private loans tend to have much lower rates compared to federal loans.

If you’re curious to know why private loan interest rates are lower, you can read more here. In summary, federal student loan rates were variable, based on the 91-day treasury bill, from 1993 to 2006 when they were changed to a fixed rate of 6.8%. Then in 2012, congress passed another law that set interest rates on student loans to the 10-year Treasury note plus 3.6 percentage points for graduate student loans, which is where we are today.

(Interestingly, if the 2006 change never happened, current rates would be 1.76% based on the 91-day treasury bill rates on 3/9/21).

By contrast, private loans rates are based on the LIBOR rate or US prime rate and can vary daily.

When you refinance to the lower, private student loan interest rates, you can choose between 5, 10, or more year plans. Regardless of which choice you make, once your refinance, you no longer qualify for government benefits like loan subsidies and the government changing the rate. All that’s left is how much you owe the private company you refinanced with. And because there’s no penalty for paying your loans off early, the longer you wait the more interest you end up paying.

So to pay the least amount of interest, you should pay off your loans as fast as possible. This is the main reason 22.3% of doctors in our survey chose to pay off their loans in under 5 years.

However, there is a second reason that was mentioned: Employer Student Loan Repayment. Yes, hospitals and other physician employer may offer student loan repayment as an incentive to recruit the best doctors. With offers ranging from $30,000 to $50,000 per year over 2-5 years, its entirely possible for a physician to have their loans paid off by their employer in less than 5 years.

Loan Repayment in More Than 5 Years

Of course, not everyone wants to, or can pay off their loan in under five years. Of our respondents, 14.7% paid off their loans in 5-10 years, 5.4% in 15 years, and 19.5% in a full 30 years!

As one doctor told me, “Half of my loans were at 6.125% so I paid those as quickly as possible. The other half are at 1.875% and will be paid over 30 years, so another 20 to go!”

Why would he wait to pay off the lower interest rate loans? Because of stock market returns.

This is where things involve a little bit of math, so please bear with me. Let’s start with the easier one. Historical SP500 returns from 1957 to 2018 are around 8%. That means for every $100 you have invested in the stock market, you’ll make $8. Compare that to $100 of loans at 1.875%. Every year, you would owe $1.88, or you could save that $1.88 by paying off $100 of loans.

Would you rather make $8 and lose $1.88 or save $1.88 and not make $8? That simple math is a big reason why people hold on to low interest debt.

But there’s more. Are you familiar with compound interest vs simple interest? This is where the math dials up a bit.

Student loans follow simple interest, with some exceptions. $100 at 10% interest per year will grow to $110 by the end of the year. After two years, add another $10. Another year, another $10. and so on. After 10 years, the balance grows to $100 of principle and $100 of interest. Or $200.

Compare that to compound interest, which is what you can expect in the stock market. With 2% gains on $100 every year, at the end of year one, you’ll have $110. But the following year you gain 10% on $110, and so on. After 10 years, the total balance is $259.37. That’s an extra $59.37.

Now, student loans will compound at certain points, such as when you refinance, enter repayment, or change plans. When one of these events occurs, the loans capitalize, or the interest bucket gets added to the principle bucket for a new “principle”. This new total number gains interest over time.

Back to the reason why doctors hold on to loans for a long time. If you can not only make a higher annual return than the cost of your student loan interest rate, but you also make compound interest compared to losing simple interest, it absolutely makes mathematical sense to continue deciding to invest over paying off your loans.

How Military Service Affects Loan Repayment

In our survey, 10 of our respondents said they had their loans covered by the US military. This works through the Health Professions Scholarship Program, or HPSP. Medical students who apply and qualify for this program will receive 4 years of full tuition, books and fees, a monthly $2,400 stipend throughout school, a $20,000 sign on bonus, monthly allowances for food and housing, officer status and more. In exchange, you have to commit to future service as a military physician.

Why Residents Can’t Afford To Pay Off Their Loans

I don’t want to disregard the last 6.2% of our survey respondents. These doctors simply marked “I’m in residency” as their current student loan repayment plan. What does that mean?

The current average resident physician salary in 2020 is $63,400. The median medical school student loan debt is $200,000. With other financial responsibilities like food, transportation, and housing, It is simply not possible to pay off all of your student loan debt during the 3+ years you’re in residency.

However! I believe that residency provides you with one major benefit. It teaches you to live like a resident.

In residency, you will work 80 hour weeks and probably feel extremely underpaid. But you will learn how to survive residency and live a happy life on $63,400. If you can continue this level of spending and avoid lifestyle inflation when you become an attending physician, you’ll be in an excellent position to tackle your student loan debt.

And if you don’t plan on paying off your loans quickly when you’re done, at the very least you’ll be able to make 36 or more qualified payments toward public service loan forgiveness to give yourself a head start.

Final Thoughts

As you can see, there are a number of different strategies that physician employ to pay off their medical school student loan debt. Which of this strategies do you prefer? How long would you take to pay off your medical school loans? Let me know in the comments below.

One thought on “How Long Does It Take To Pay Off Medical School Loans?”