Data continues to show that doctors are among the highest earners in the country. But I know plenty of doctors, and almost none of them are living lavish lifestyles. If that’s the case, then what do doctors do with their money?

Doctors are traditionally high earning professionals. However, they also have a number of obligations including repayment of large amounts of student loans, taxes, and other life expenses. In addition, because doctors earn their money later in life, their net worth does not often reflect what one would expect, given their earnings.

What Expenses Do Doctors Have?

We’ve all heard the story of the rich doctor. The one who went to medical school because he know it would make him rich. The doctor who spends all of their money on luxury cars, massive homes in upscale neighborhoods, and expensive travel.

Of course, some doctors are like that. You don’t even have to look to hard to meet one. Maybe they’re more spend-thrifty. Or they could be one of the higher earning types of physician. But they’re not the average doctor.

The average doctor is more likely to initially be excited by their first paycheck, then feel a sense of shock at the amount of tax taken out. Usually at that point, they realize how different their take home pay is compared to what they expected.

Contrary to the stereotype of the rich doctor, the average doctor doesn’t feel rich. I asked a group of physicians what their biggest expenses were, and none of them said private planes or designer clothes. The three most common answers? Childcare, student loans, and mortgage payments.

It turns out the average doctor just spends money on regular things.

Do Doctors Really Make That Much Money

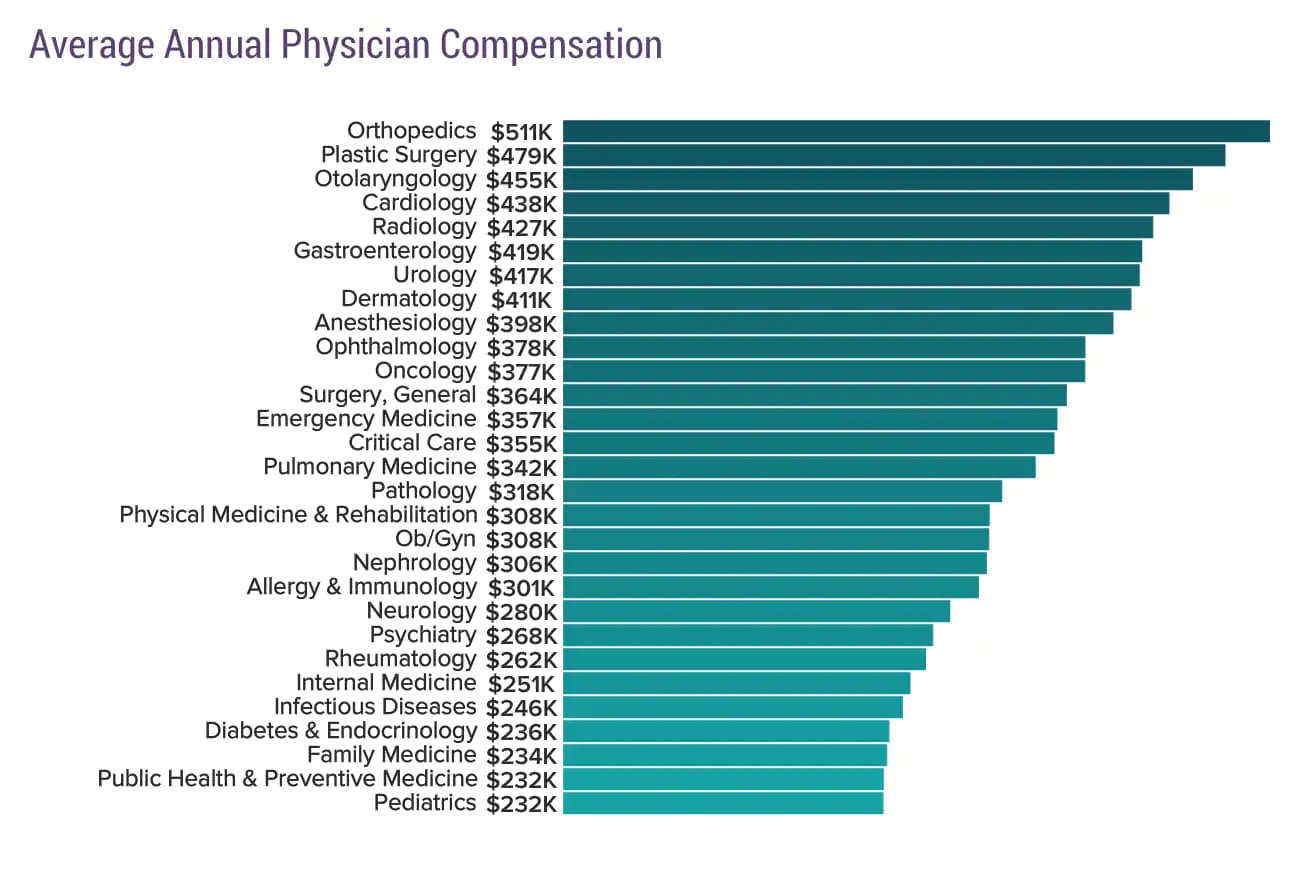

Chances are if you’re reading article that you’ve looked up how much money doctors make. If you haven’t, here’s the most commonly cited data from the Medscape Annual Physician Compensation Survey.

It looks like a lot, right? As a medical student, that chart was enough to change some people’s minds on what type of doctor they wanted to be. And as a resident, I couldn’t wait to get my first paycheck. But now I make that salary, and I don’t feel rich. Why is that?

Becoming a doctor is a long process. It’s at least 7 years between medical school and residency. Sometimes even longer for those becoming more specialized doctors. And while you’re in training, you don’t have a lot of time or money.

As a result, two things happen. First, your student loans, which average $200,000 upon graduating medical school, gain interest and get bigger. Seven years of 6.8% interest turns that $200,000 into $295,200 by the time you start working.

Secondly, your don’t get your first “real paycheck” until you’re most likely into your 30s, even later for some doctors. Since you didn’t have time or money to travel, buy a house, or get a new car in training, you quickly realize you have a lot of catching up to do.

And lastly, there’s taxes, the other most most common response among the doctors i asked. The numbers in that Medscape survey are pre-tax averages. Actual take home pay is significantly lower.

So yes, doctors do make a lot of money. According to Medscape, $243k for primary care physicians and $346k for specialists to be exact. But it’s not until much later in life, it’s much less than you think, and you start with a negative net worth. Most doctors would have more money at the same age if they did something different from the beginning. Maybe something like becoming a software engineer.

How Much Do Doctors Take Home

Earlier I mentioned taxes briefly, but if you want to know how much money physicians take home, it helps to dig into taxes a little deeper. As a whole, tax policy can be very complex and it really deserves its own post. But to get an idea of how much money doctors have to spend, I’ll give two examples.

Meet Dr. Katie and Dr. Jimmy.

Katie is an Emergency Physician in Virginia making about $350,000 per year, close to the average for ER doctors on the Medscape report. She’s also a big saver and complete funds her 401k, 457, and HSA. Then adds in pre-tax health insurance premiums. All together that leaves her with $301,400 in taxable income. Plugging that into the after tax paycheck calculator gives her $191,864 in take home pay, or about $16,000 per month.

Jimmy, our other doctor, is a primary care physician working in family medicine. He also lives in Virginia, but only makes $234,000 per year. Like Katie, he pays for health insurance and completely fills his retirement accounts, then pays taxes on the rest. That leaves him with $124,956 in take home pay, or about $10,700 per month.

Here are those numbers again, this time organized into a more helpful table.

| Jimmy | Katie | |

| Compensation | $234,000 | $350,000 |

| Health Insurance | $6,000 | $6,000 |

| Pre-tax 401k | $19,500 | $19,500 |

| Pre-tax 457 | $19,500 | $19,500 |

| HSA | $3,600 | $3,600 |

| Total Taxable Income | $185,400 | $301,400 |

| Federal Income Tax | $39,128 | $78,955 |

| State Income Tax | $10,091 | $16,761 |

| FICA | $11,226 | $13,820 |

| Take Home Pay | $124,956 | $191,864 |

Your exact numbers may differ depending on your earnings, state, or local taxes, but looking at Dr. Jimmy and Dr. Katie’s numbers should give you an idea of how much primary care and specialist physicians take home in addition to how much tax they pay.

Even with maximizing their pre-tax benefits, they pay a good amount in taxes. For primary care, $60,000. And for our ER doctor, almost $110,000.

Are Doctors Bad With Money

None of this is meant to say that doctors don’t make a lot of money. Compared to the average American salary, $191,864 per year in take home pay is pretty good. $124,956 isn’t bad either. It’s not Jeff Bezos or Elon Musk money, but it should be enough for doctors to be rich, right?

Then why, along with the stereotype of “the rich doctor”, is there also the stereotype that doctors are bad with money?

Let’s dig a little deeper. First, let’s define what it means to be bad with money.

To me, someone who’s bad with money isn’t growing their net worth. That means they carry a lot of debts and gain very little assets. For someone like a doctor with high take home pay, I’d say they’re bad with money if they spend freely, don’t pay down their debts, and don’t purchase assets.

The stereotypical “rich doctor” is starting to make more sense now.

Net Worth = Assets – Debts

See, traditionally doctors were thought of as “bad with money” because they kept up the appearance of being rich. Finally becoming a doctor after 30 and suddenly earning a high income can make someone feel entitled. Entitled to a million dollar home. Entitled to a fancy car. Entitled to the appearance of being rich. It’s this entitlement that leads physicians to have lower net worths.

But lately, the pendulum has started to swing the other way. In favor of an increasing number of doctors being good with money. More and more, physicians are learning the basics of personal finance and investing. And fewer and fewer seek out lavish lifestyles, realizing that being a millionaire means saving a million dollars, not spending it.

I say some, but not every physician is so frugal.

So now we have three types of doctors when it comes to money. Spendthrifty non savers who appear rich. Responsible savers who max out their retirement accounts and might save 20%. And extreme savers who spend very little and save over 50%.

How Much Does The Average Doctor Save?

You may be wondering, what type of doctor am I? Is The Average Doctor a spendthrift with a Maserati? Responsible? Or is he an extreme saver?

I actually fall in the latter category. Together with Mrs. Average Doctor, we save about 70% of our earnings. And we do it without feeling like we’re sacrificing much. We are very fortunate.

How you decide to spend your money is up to you. For me, I think doctors are in an incredible position. Sure, we might have made more money if we became software developers instead of doctors. And I struggle with some level of jealousy when I see YouTubers raking in millions per year.

But I’ve also worked for minimum wage, and I know how it feels to see yourself working for someone for the rest of your life. Instead of using our physician incomes to flash our wealth and flex, I prefer to work toward FI/RE and gain my freedom.

That, to me, is the ultimate luxury that a physician income can buy. And that is when I will finally feel like a “rich doctor”.