Assets For Doctors

They say money doesn’t grow on trees. And they’re not wrong.

In fact, the opposite is true. if you leave it alone, your money actually shrinks!

This is because of inflation. An economic force that constantly makes things more expensive, thereby making your money less valuable. Reducing your spending power. Making you less able to buy more things.

It gets a bit more complex, but for now, imagine it like this.

Imagine you’re in a boat.

No, not that boat. You’re in a paddle boat. You know, one of those wooden ones like in Tom Sawyer and Huckleberry Finn. And you’re in that boat trying to make it up river.

But the current is working against you. And every time you stop paddling, you move just a little bit back downstream.

That backwards current is inflation. To beat it, you can work faster, or work harder, but it’s always there waiting for you to stop.

You need something else. Something to do the work for you. Something that can automatically beat the current.

You need assets.

What Are Assets?

Technically, assets are simply anything that brings you value. They can really be anything.

Like this:

John is an asset to his company (because he makes his boss look good to his boss’s boss)

Access to the internet is an asset to developing countries

Nick’s 1967 Shelby Mustang GT500 is an asset.

And so is Mary’s fabergé egg collection.

However, when we’re talking about assets in personal finance, we’re talking about things that bring value in the form of money. You can probably turn a profit reselling a 1967 Shelby GT500 to a Nick Cage fan, and maybe one day fabergé eggs will be worth $1 Million. But there are a few specific assets that have shown, over time, a consistently high likelihood to increase in value and make more money.

Those are Stocks, Bonds, and Real Estate.

Stocks

Stocks are simply shares of a company. Created as a way for businesses to generate money. See, as businesses grow, they usually need lots of lots of money to buy stuff and build things. But they don’t always have enough. And they can’t always make enough just by selling their product.

So instead, they sell percentages of ownership (shares) of the company itself. To you. In exchange for money.

For example, let’s say Dr. Shelby runs Shelby’s Scrub Store. Right now she just received an order that would generate $5 Million dollars. But that’s a lot of scrubs. And she still needs to get them, package them, etc., which costs her money. Say $2 million.

But she doesn’t have $2 million dollars, and can’t fill the order without it. So she needs to raise money. But because money isn’t free, Dr. Shelby decides to sell stock in her store.

She creates thousands of pieces of paper that say “This stock is worth 0.0004% of Shelby’s Scrub Store.” And she sells them each for $20.

Now you can convert $20 of your money into assets by buying stock in Shelby’s Scrub Store.

For now, that stock is only worth $20. But over time, as Shelby’s Scrub Store sells more scrubs, grows, and becomes more valuable, those stocks also become more valuable. And the best part is, that happens without any additional work from you, the shareholder.

Bonds

Bonds are sort of like loans, or I.O.U.s. And they’re another way for companies to make money. This time, without forcing the companies to give up any amount of ownership.

Essentially what happens is the company, say Shelby’s Scrubs Store (SSS), goes into debt. Shelby borrows $3 million to fill her order promises to pay it back plus interest over a set time and at a specific rate, known as the coupon rate. That $3 Million debt gets turned into smaller pieces and traded as bonds on the market.

So if you buy $1000 of bonds from SSS that matures after 10 years at an annual coupon rate of 10%, you’ll make $100 per year, or $1000 after 10 years.

As you can see, bonds are a much more predictable class of assets when compared to stocks. The parameters are typically set out at the start, and the value doesn’t tend to fluctuate as much as it does with stocks.

Now, bonds do get more complex, which we’ll address in a later post, but this is a great place to start.

Real Estate

When you think of real estate you probably think about buying and owning houses. Which is absolutely correct (although slightly limited). Probably the most commonly owned asset and the one people are most familiar with is your home. And most homeowners know that values of real estate tend to increase over time.

As an asset class, though, real estate involves a whole lot more. You can purchase real estate assets in the form of single family homes, multi-unit homes, apartments, and commercial real estate where you would manage the property yourself. You can also buy shares in something called real estate investment trusts (REITs), which are sort of like stocks in companies that focus solely on buying, managing, and selling real estate. And then there are other options like flipping houses, private lending, and more.

We’ll take a much deeper dive into the world of real estate in a later post, but for now, I want you to understand real estate as a major asset class. Unlike money, which we’ve seen decreases in value over time through inflation, real estate tends to appreciate through multiple factors, such as supply and demand.

Why Are Assets Important?

Now that you’re familiar with a few different types of assets, I’m sure you’re wondering why I keep talking about them. Why exactly are assets so important?

First, it’s been consistently shown that people who own assets have significantly higher wealth than people who don’t own assets. This is particularly apparent when comparing wealth between homeowners and renters, which the fed does every few years. According to their data, homeowners (asset owners) have almost 44x more net worth compared to renters.

Secondly, as you’ve seen, your money is constantly decreasing in value over time through that thing called inflation. Unlike money, assets can actually increase in value over time. Through mechanisms like supply and demand, interest rates, and compound interest.

Importantly, their potential to increase in value is actually infinite. And that’s without any increased effort from you. Through something called scale.

Thirdly, purchasing assets is one of the key ways that governments stimulate the economy. Think back to 2008 when the great recession hit. If you don’t remember, check out this great movie available for free on YouTube that gives you a behind the scenes look into what happened and how the government responded back then.

Essentially, the people in charge decided to build a “giant wall of money” to protect the economy. But, without getting political, they didn’t do this by showering citizens with planes full of dollar bills. Instead, they purchased assets, leading to a soaring stock market.

Think about it…if you purchased a bunch of assets in 2008, you’ve probably made a boatload of money by now. If you simply held on to your cash, you missed out.

And finally, assets are simply how most rich people get rich in the first place. For example, Jeff Bezos, one of the wealthiest men in the world, didn’t get to that point by selling books. He got there by owning a bunch of Amazon stock and increasing the value of the company. You could do the same thing without learning to code or logistics or doing anything other than simply purchasing the right assets. Don’t believe me? Just look at Warren Buffet.

How Do Assets Grow?

Ok, so I mentioned that assets can increase in value. And I briefly mentioned supply and demand, interest rates, and compound interest. The first two are easy to understand.

Supply and demand is pretty much the idea that things cost more when a lot of people want them (higher demand) and when there’s not of it to go around (lower supply). In contrast, things cost less when less people want them (lower demand) and when there’s a lot of it available (higher supply). Interest rates, like you saw in our discussion of bonds, are just an agreed upon way to make payments on a loan over time. Compound interest, however, gets a bit more complicated.

Compound Interest

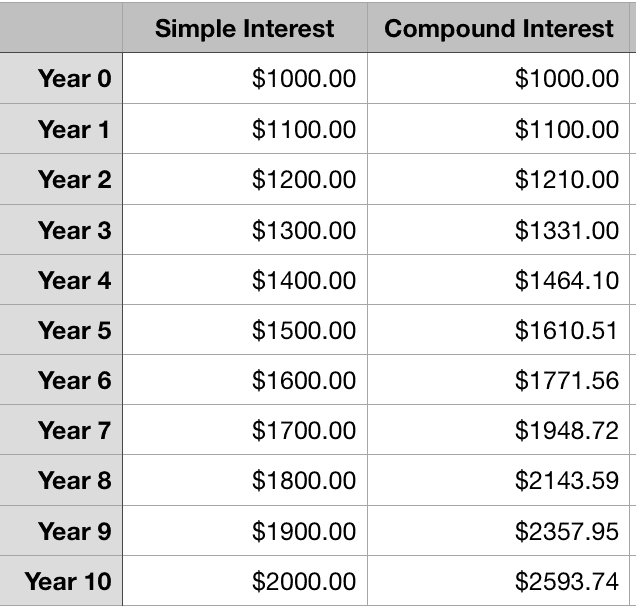

Compound interest is important. It’s the key way that your money turns into more money. But to understand it requires a bit of math. So first, let me show you the difference in money over time between simple and compound interest on this spreadsheet.

And here’s how it works.

Simple interest is simple. If you make 10% every year on 1000 invested, that’s $100 every year. Doing this for 10 years would make you $1000, leaving you with $2000.

Compound interest, on the other hand, makes even more.

After one year, you would still make $100. 1000 x 10% = 1000 + 100.

But unlike simple interest, that extra money you made gets re-added to your initial investment every subsequent year.

So in year two, you make 10% of 1100. 1100 x 10% = 1210.

In year three, 10% of 1210, or 1331.

And so on until after 10 years you end up with $2593.

That’s a $593 difference, or 59% more than with simple interest.

Huge difference, right?

Now imagine that with bigger numbers. That’s how the engineer made so much more money than the doctor. That’s the power of compound interest.

But Wait! Coronavirus! The Market Just Crashed!!!!

Hold up a minute!

I wrote this article 4 weeks ago praising the immense value of assets and how they’re one of the best ways to make money! Then all of a sudden there’s coronavirus, an oil war, and a stock market crash. If you’re reading this today, you’re probably also familiar with these events.

Now, it my entirely my intention to create a blog series about basics of personal finance and investing without being topical with current events. But something like this has to be talked about at at this point. Especially in a post about personal finance.

Here’s what you need to know. Nothing that you read above has changed. Assets are still one of the primary ways to make your money make money.

BUT! While assets can potentially increase to infinity, they can also go down. In fact, they tend to go down pretty frequently. And that’s ok.

Because over enough time, they also tend to go up.

And that’s what I want you to take away from this current coronavirus stock market crash. Don’t Panic! It’s ok.

What this means for you depends entirely on your timeline. If you’re planning to invest for another 20-30 years, this is just a blip.

And if you’re worried about this happening when you’re 2 years away from retirement, don’t worry. There are ways to lower your risk.

In another post, I’ll cover more advanced strategies for investing in assets and limiting risks. For now, keep learning. Because the key to success is learning, understanding, consistency, and stability.

And because if you’re early in your career, the last few days are just a big ol’ sale.

How do I get assets? (This week’s homework)

Hopefully, you’ve read this far and I’ve convinced you to purchase assets to increase your wealth. But maybe you don’t know how to do it. Don’t worry, it’s incredibly easy.

The first step is figuring out which assets you want to buy.

If it’s shares in a friend’s company, I recommend finding a lawyer and filling out a bunch of paperwork.

If it’s beanie babies, pogs, or pokemon cards, I beg you to reconsider, but you can just buy them on EBay.

But if you’ve been paying attention and its stocks and bonds you want, I recommend opening an account with a brokerage firm. Take your pick between companies like Charles Schwab, TD Ameritrade, Fidelity, and the one I use the most, Vanguard (among others).

Pick your company, set up your account, choose your investments, and transfer your money. Simple as that, right?

Well…ok…there’s a few more things you should learn before you start choosing between the thousands of individual stocks, ETFs, managed mutual funds, and index funds that you’ll see in those brokerage firms. Right now, I recommend just making an account and familiarizing yourself with the system.

For now, I just want you to understand the value of assets. In a few posts I’ll show you how I decide what to buy and teach you how to pick your own investments.

Next week…

If you’ve read this far, thank you! This is a new and growing blog and I’m grateful for every reader. Please leave a comment below and if you feel this article would help someone you know, please share it.

There’s a lot more to say about assets, but in this back to basics series, I only want to cover only the basics. We’ll get into more advanced topics later.

If you’re wondering, next time we’ll be discussing the opposite of assets…Debt! Understanding it and how to manage it.

See you next time!

One thought on “Back to Basics: The Importance of Assets”